At Shield Mortgage Brokers, we help home buyers and investors in Maroubra and across Sydney’s Eastern Suburbs secure the right home loan to match their goals. Whether you're buying your first property, refinancing to a better rate, or expanding your investment portfolio, we provide tailored advice and end-to-end support.

Maroubra offers a relaxed beachside lifestyle with strong community appeal, quality schools, and easy access to the Sydney CBD. With rising demand and limited housing supply, the local property market is competitive. That’s why it pays to be prepared. We focus on fast pre-approvals so you can move confidently when the right property becomes available.

✅ First home buyers

✅ Property investors

✅ Home loan refinancing

✅ Self-employed borrowers

✅ Low deposit loans

We’re your local mortgage experts servicing Maroubra and the Eastern Suburbs. We're ready to help you secure the right finance quickly, with a process that puts your needs first.

Home Loan

With access to hundreds of Home Loans, we're sure to be able to find the right one for you

Home Loan

Investment Property Loan

Investment loans for property investors. We can help self employed, PAYG, family trusts, and SMSF.

Investment LoanOur goal is to help you get pre-approved so you can negotiate with confidence, knowing exactly how much you can borrow. We begin with a strategy session, where we take the time to understand your property goals and personal plans. This forms the foundation for a tailored loan strategy that supports your entire financial journey. Buying a home or investment property in Maroubra is a significant step. With its beachside lifestyle, family-friendly streets, and proximity to schools, parks, and transport, Maroubra continues to attract strong demand. Your loan should support both your short-term needs and long-term goals. That’s why we focus on building your borrowing strategy from the beginning, not leaving it to chance.

As part of this process, we will complete standard Know Your Customer (KYC) checks and assess your financial position by reviewing:

This allows us to determine your borrowing capacity and recommend the most suitable loan options. If you're based in Maroubra or nearby suburbs, we’re happy to meet in person. Prefer to handle it online? We can complete the entire process remotely at a time that suits you.

✅ Access discounted rates and offers

✅ Tailored loan strategy to fit your needs

✅ No broker fees for majority of borrowers

✅ Ongoing loan reviews to keep you ahead

✅ Specialise in complex loan situations

Working with a mortgage broker gives you access to loan options and benefits that banks don’t always promote. At Shield Mortgage Brokers, we help clients in Maroubra and across Sydney’s Eastern Suburbs go beyond standard loan products to secure sharper interest rates, reduce upfront costs, and structure finance that supports long-term goals.

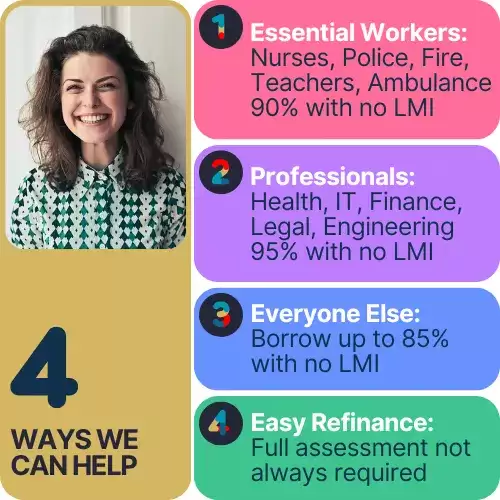

In high-demand areas like Maroubra, Coogee, Randwick, Bondi, and Kensington, rising property prices can be a challenge for many buyers. We work with clients in specific professions who may qualify for more flexible lending policies. If you’re an essential services worker or hold a university degree, you may be eligible for low deposit loans without the added cost of Lenders Mortgage Insurance (LMI). This can help you buy sooner and save significantly.

Already own a home in Maroubra or nearby? We can help you refinance to a more competitive rate, often without requiring a full reassessment. Some lenders offer streamlined refinance options that make switching easy and cost-effective.

As your broker, we compare your loan scenario across multiple lenders to find the best available deal. This often results in sharper pricing than what you’ll find advertised directly. Our role is to uncover these opportunities, structure your loan correctly, and guide you through a smooth and transparent process from start to finish.

✅ Low Deposit Loans

✅ No LMI Options

✅ Simpler Refinance Loans

✅ First Home Loans

✅ Investor Loans

✅ Low Doc Self Employed

✅ Family Trust Loans

✅ 40 year home loans

Amir Masinovic founded Shield Mortgage Brokers to help borrowers reach their goals by providing guidance, smarter choices, and access to the best loans available. With connections to over 75 of Australia’s leading home loan, commercial loan, and asset finance lenders including major banks, trusted non-banks, specialist commercial lenders, and niche providers, I can help you find a solution tailored to your unique circumstances.

Proudly serving Maroubra and the surrounding Eastern Suburbs, I offer flexible appointment options, online, in-person, or over the phone, to suit your schedule. Simply get in touch to book a time that works for you.

Strategic Advice, Not Just Loan Products

More than just comparing rates. we'll take the time to understand your full financial picture and long-term plans. Whether you're buying your first home, refinancing, or investing, we'll help structure your loan to support your broader goals, giving you confidence at every stage.

I’ve worked with Shield Mortgage Brokers a couple of times now, and they’ve always made the whole process so much easier. They really listen to what you need and help you find the best loan options. Highly recommend if you’re looking for someone who knows their stuff.

Harry Jacob

I was struggling to refinance my home loan myself until I reached out to Amir at Shield Mortgage Brokers. He not only found me a loan but also structured it in a way that cost me less each month. His knowledge and customer-focused approach made the process less stressful. Highly recommended!

Katrina M.

Amir helped me get a debt consolidation loan that improved my monthly cashflows by some degree. Recommended service.

Aiden Tirrell

Schedule a time to chat, we’ll understand your goals and advise borrowing capacity

Once you provide us your documents we scan the market and review your options together

We'll prepare the application and confirm your approvals

We'll support your conveyancer/agent as required through to settlement

We can meet in person, Zoom or phone, whatever works best for you.

Exploring the variety of loan options available to locals in Maroubra and nearby areas can feel overwhelming. This guide simplifies the process, helping you make informed choices suited to your financial situation.

These loans are tailored for individuals who plan to live in their Maroubra property. Lenders often view this as a lower-risk option, resulting in competitive interest rates and favourable terms. This makes owner-occupied loans an excellent choice for those buying a home to live in.

With this type of loan, you pay only the interest for a set period, typically five to ten years. While this can reduce repayments during the initial term, the overall cost increases once principal repayments begin, requiring careful financial planning.

These loans combine repayments of both the principal and interest. Over time, the total debt decreases steadily, ensuring the loan is fully repaid by the end of the term. This structure provides a clear path to financial freedom.

These loans come with interest rates that change based on market trends, influencing monthly repayments and the overall cost of borrowing. While they offer flexibility, fluctuations in rates mean monthly repayments can vary.

A fixed-rate loan secures your interest rate for a specified term, typically between one and five years, ensuring consistent repayments during this period. After the fixed term, the loan usually reverts to a variable rate, which may increase or decrease depending on market conditions.

Bridging loans are designed for individuals transitioning between properties. They provide short-term funding while waiting for the sale of your current home. Though these loans often have higher interest rates and shorter terms, they are a practical solution for covering gaps in financing. Proceeds from the property sale are usually used to pay off the loan.

Understanding these loan types allows you to choose a mortgage that suits your needs and aligns with your financial goals.

Shield Mortgage Brokers proudly services the entire Eastern Suburbs of Sydney and surrounding areas. Whether you are purchasing a home, upgrading, investing, or refinancing, we are here to help you find the right lending solution. We work with clients in the following suburbs:

Alexandria 2015, Banksmeadow 2019, Beaconsfield 2015, Bellevue Hill 2023, Bondi 2026, Bondi Beach 2026, Bondi Junction 2022, Botany 2019, Bronte 2024, Centennial Park 2021, Chifley 2036, Clovelly 2031, Coogee 2034, Darling Point 2027, Darlinghurst 2010, Dover Heights 2030, Double Bay 2028, Eastlakes 2018, Edgecliff 2027, Elizabeth Bay 2011, Hillsdale 2036, Kensington 2033, Kingsford 2032, La Perouse 2036, Little Bay 2036, Malabar 2036, Maroubra 2035, Mascot 2020, Matraville 2036, Moore Park 2021, Paddington 2021, Pagewood 2035, Phillip Bay 2036, Point Piper 2027, Potts Point 2011, Queens Park 2022, Randwick 2031, Redfern 2016, Rose Bay 2029, Rosebery 2018, Rushcutters Bay 2011, South Coogee 2034, Surry Hills 2010, Tamarama 2026, Vaucluse 2030, Watsons Bay 2030, Waverley 2024, Woollahra 2025, Zetland 2017.

Looking for a trusted mortgage broker in the Eastern Suburbs of Sydney? Contact Shield Mortgage Brokers today to discuss home loan pre-approval, refinancing, or property investment finance tailored to your needs.

We love helping First Home Buyers and hope you keep us as part of your team of experts when you continue up the property ladder in the future. With our experience in the end-to-end process, we provide the right guidance to First Home Buyers. Enquire about joining our free mentoring program for First Home Buyers. We're also across the various schemes to help First Home Buyers such as the First Home Owners Grant and the various stamp duty exemptions available.

Of course! We believe that we can find the best interest rate for you to refinance to, whether it's a Home Loan or Investment Loan.

Mortgage Brokers are there to help you find the right loan whether it be from the major banks, smaller lenders or other sources. We have a broad range of products (more than any single lender can offer) which means we can do all the legwork to find the right loan for you.

All of our Mortgage Brokers are accredited and members of the Finance Brokers Association of Australia (FBAA). They are extremely professional and provide exceptional service across a range of lending options.

We can help with Home and Investment Loans, Construction Loans, Car Loans, Personal Loans and much more. If you're looking to borrow to buy something, we can probably help.

We take look at a wide range of products available from Banks, Credit Unions & other lenders across the country. This means we can search thousands of products and make sure we're always recommending the best Home Loans for our clients.