Where to Start?

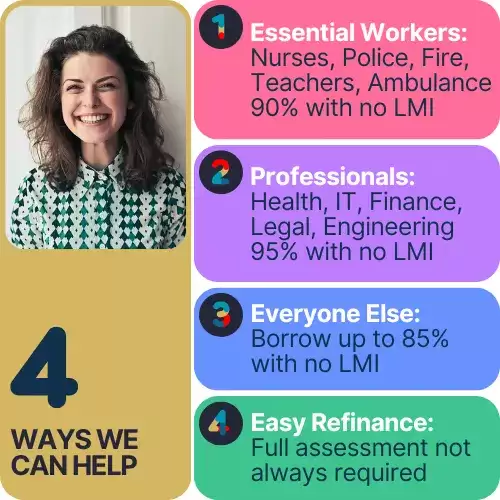

Buying an investment property requires planning, especially in a fast-moving market where homes sell quickly. Pre-approval helps you avoid delays, strengthen your negotiating position, and understand key factors like LVR, borrowing capacity, loan structures, and how features such as offset accounts or interest-only repayments impact cash flow and tax.

At Shield Mortgage Brokers, we assess your finances, explain your options, and structure your loan to match your investment goals. With pre-approval in place, you’re ready to act with confidence when the right property comes along.