We'll Help You Understand the Loan Types, Grants and Incentives to Get You into Your First Home

Buying your first home is an exciting milestone, but it can also feel overwhelming. At Shield Mortgage Brokers, we’re dedicated to simplifying the process and helping you make informed decisions. With access to banks and lenders nationwide, we find home loan options tailored to your unique needs, whether you prefer fixed or variable rates, or want to explore offset accounts.

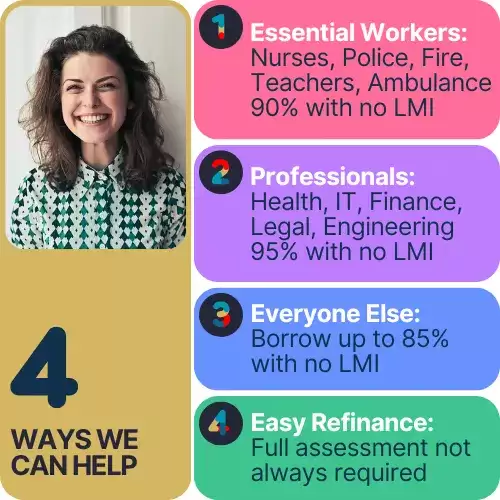

Understanding Your Borrowing Capacity

We guide you by assessing your financial situation, including credit history, loan amount, and loan-to-value ratio (LVR), so you know exactly how much you can borrow and which interest rates you may qualify for. We also help you check eligibility for Lenders Mortgage Insurance (LMI) waivers and First Home Owner Grants (FHOG)—valuable programs that can reduce upfront costs.

Streamlined Application Process & Pre-Approval

Applying for a home loan doesn’t have to be complicated. We simplify the process from start to finish, assisting with document collection, loan application, and securing pre-approval. Pre-approval strengthens your position as a buyer and gives you a clear budget to shop within.

Budgeting for Stamp Duty and Other Costs

Stamp duty can impact your upfront expenses. Our experts help you understand how this government tax applies to your purchase and explore any concessions available to first home buyers.

Considering Investment Properties?

If you’re interested in your first investment property, we can guide you through the investment loan application process, ensuring you’re prepared and confident.

Need a Mentor to Guide You?

Shield Mortgage Brokers is here to support you with personalised advice and access to a wide range of lenders. Contact us today to start your journey toward home ownership or property investment with confidence.